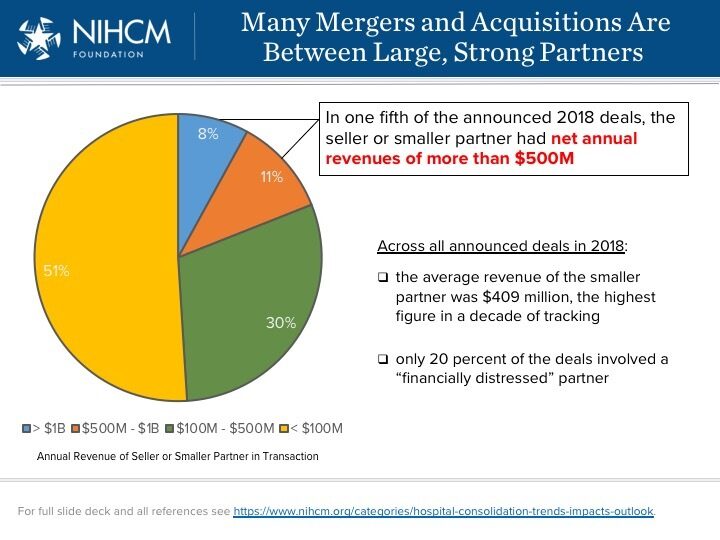

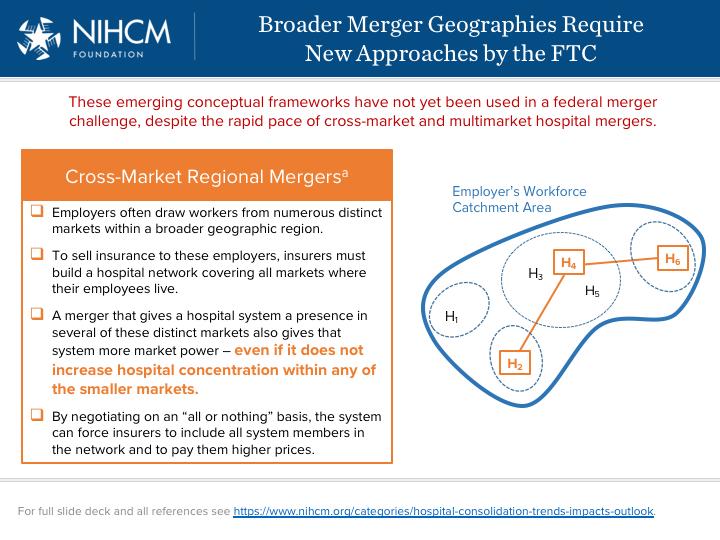

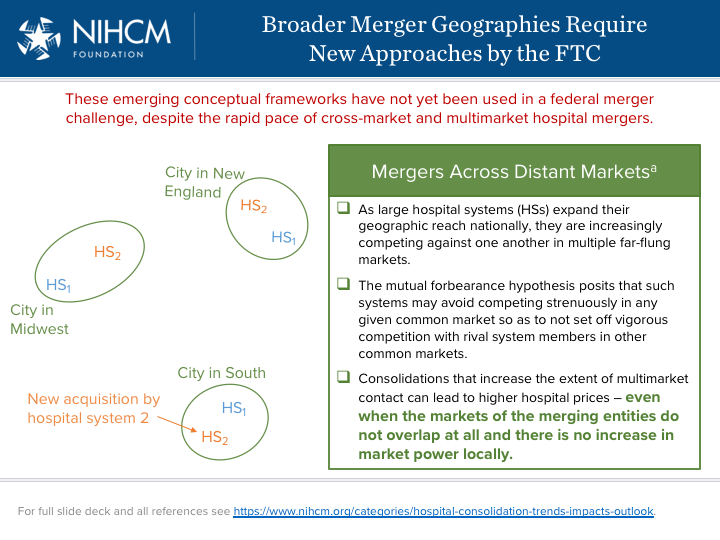

class: center, middle, inverse, title-slide # Module 3: Hospital Pricing and Competition ## Part 4: Mergers and Competition Policy ### Ian McCarthy | Emory University ### Econ 372 --- <!-- Adjust some CSS code for font size and maintain R code font size --> <style type="text/css"> .remark-slide-content { font-size: 30px; padding: 1em 2em 1em 2em; } .remark-code, .remark-inline-code { font-size: 20px; } </style> <!-- Set R options for how code chunks are displayed and load packages --> # Types of hospitals involved in mergers .center[  ] --- # Types of hospitals involved in mergers - Ascension-Presence: Largest non-profit system in US adds 10 hospitals to existing 9 hospitals in Chicago - Fairview-HealthEast: 11 hospital system becomes largest in Twin Cities area - Hospital corporation of america (HCA) adds 4 hospitals to the 10 existing HCA hospitals in Houston - Northwestern-Centegra: Forms 10 hospital system in Chicago - Emory-DeKalb: Forms 10 hospital system in Atlanta - Jefferson-Einstein: Forms 18 hospital system in Philadelphia area .footnote[Source: NIHCM Hospital Consolidation Trends] --- # Different merger types Essentially two types of mergers: 1. "Within-market" 2. "Out-of-market" -- Why do you think these matter? --- # Within-market mergers - Most well-understood merger type - Established tools for examination in anti-trust - Defining the market is still a contentious issue --- # Within-market mergers - Listed previously (Emory-DeKalb, etc.) - **Big** price effects - 20 to 40% in many studies - Up to 60% in some studies - Bigger increases the closer are the hospitals - Price increases spillover to other hospitals too - Account for about 50% of all mergers since 2000 --- # Out-of-market mergers - Less understood - No formal structure for analyzing in court - These types of mergers are essentially permitted without risk of DOJ/FTC challenge --- # Out-of-market mergers - Involve larger systems spanning different isolated markets - Advocate-Aurora: 27 hospital system in IL and WI - Baptist Memorial-Mississippi Baptist: 22 hospitals in TN, AR, and MS - UPMC-Pinnacle: 24 hospital system recently added 8 in central PA - Catholic Health Initiatives-Dignity Health: 142 hospitals in 21 states - HCA: 177 hospitals in 21 states - RCCH HealthCare Partners: 89 hospitals in 30 states, focusing on non-urban areas - About 35% of all mergers are out-of-market but in same state, 15% out-of-state - Smaller but meaningful price increases, 5 to 10% --- # How do they increase prices? - Already discussed within-market mergers, outside options, and bargaining power - What about out-of-market mergers? --- # How do they increase prices? Two ways this can happen theoretically: 1. Common customers (hospital markets are local, but insurance markets are more broad) 2. Multi-market contact (particularly relevant for understanding out-of-state mergers) --- # 1. Common customers .center[  ] --- # 2. Multimarket contact .center[  ] --- # Where do we go frome here? 1. Adopt sensible policies - Certificate of need laws - Certificate of public advantage - Scope of practice laws - Any willing provider laws - Site-based payment differentials (encourage vertical integration) 2. Antitrust enforcement --- # A note on surprise billing Some hope here following the **No Surprises Act** (in effect January 2022): - Emergency care (excluding ground ambulances?) - In-network facilities - New process... - OON provider bills health plan - Health plan communicates median in-network amount - Provider bills cost-sharing to patient -- - **But** patient can be asked to waive rights --- # Finishing the class - Please review the Brookings Report, [Making health care markets work](https://www.brookings.edu/research/making-health-care-markets-work-competition-policy-for-health-care/)