Hospital Pricing and Pay for Performance

Ian McCarthy | Emory University

Outline for Today

- Understanding Hospital Pricing

- Recent Pay-for-Performance Programs

- P4P and Prices

Hospital Prices

What is a hospital price?

Defining characteristic of hospital services: it’s complicated!

What is a hospital price?

Lots of different payers paying lots of different prices:

- Medicare fee-for-service prices

- Medicaid payments

- Private insurance negotiations (including Medicare Advantage)

- But what about the price to patients?

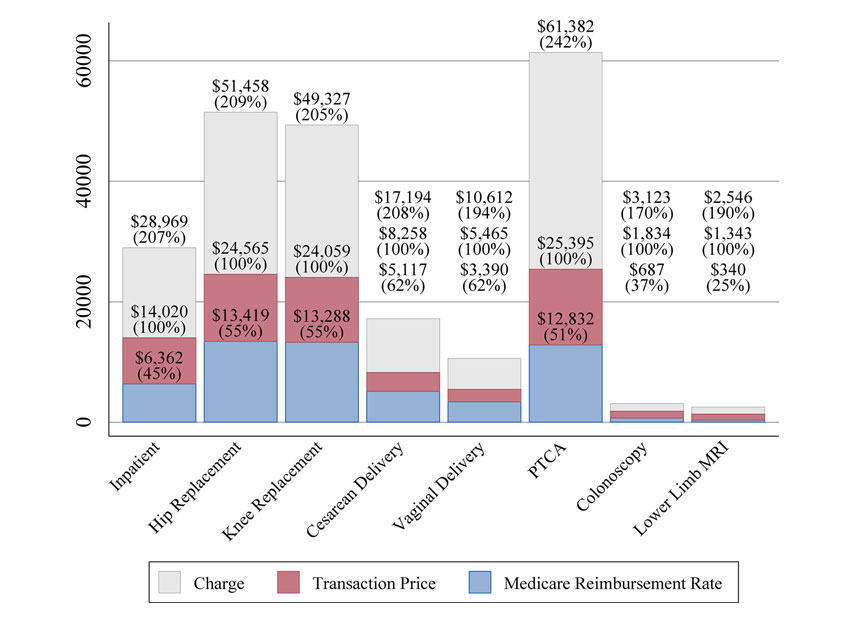

Price \(\neq\) charge \(\neq\) cost \(\neq\) patient out-of-pocket spending

What is a hospital price?

What is a hospital price?

Not clear what exactly is negotiated…

Fee-for-service

- price per procedure

- percentage of charges

- markup over Medicare rates

Capitation

- payment per patient

- pay-for-performance

- shared savings

What is a hospital price?

In most economic discussions, a hospital’s “price” refers to the allowed payment negotiated with insurers. That’s typically the definition I’ll use as well.

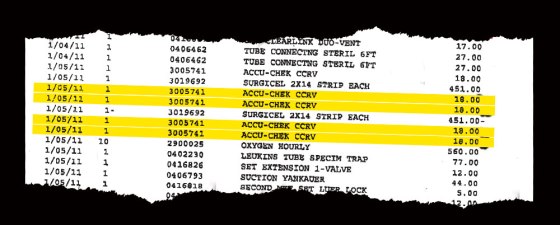

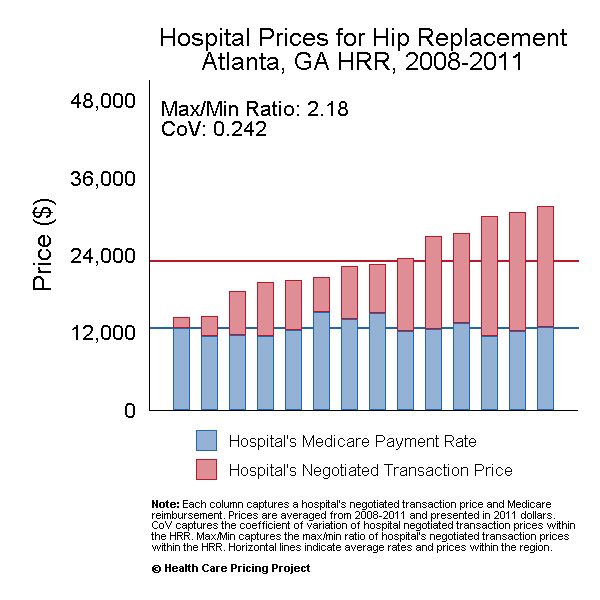

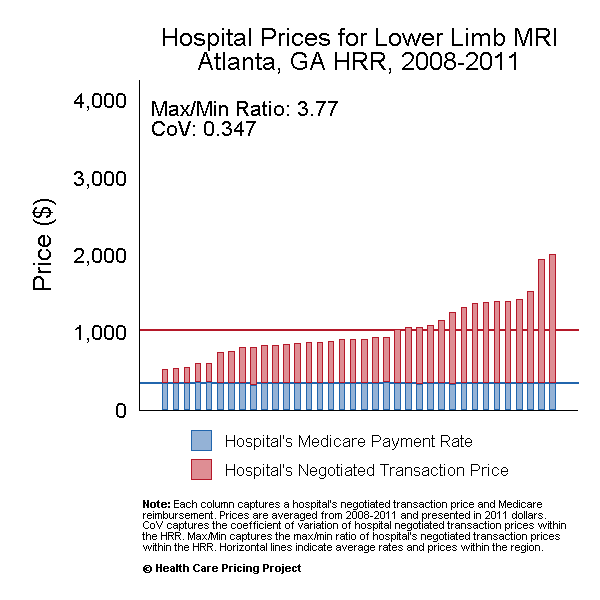

Hospital prices in real life

A few empirical facts:

- Hospital services are expensive

- Prices vary dramatically across different areas

- Lack of competition is a major reason for high prices

Hospital prices in real life

Hospital Pay for Performance (P4P)

Basic Idea

- FFS payments create an incentive to overtreat

- Capitated payments create an incentive to undertreat

- Neither is necessarily a problem unless patient care is adversely affected

Current P4P Programs

There are three main hospital-based P4P programs in Medicare right now, details available here:

- Hospital Readmissions Reduction Program

- Hospital Value-based Purchasing Program

- Hospital-Acquired Condition Reduction Program

HRRP

- Reduces Medicare IPPS payments to hospitals with excess 30-day readmission rates for selected conditions (e.g., AMI, HF, pneumonia)

- Penalties are based on risk-adjusted excess readmission ratios relative to national benchmarks and are capped at 3% of base operating DRG payments

- Purely punitive (no bonuses, only penalties)

- Significant debate surrounding risk adjustment and potential unintended consequences

- HRRP Tracker

VBP Program

- Redistributes Medicare payments across hospitals based on a composite performance score covering clinical outcomes, patient experience (HCAHPS), safety, and efficiency

- Funding is budget-neutral: CMS withholds a fixed percentage of payments from all hospitals and redistributes it based on relative performance, creating both winners and losers

- VBP Tracker

HAC Reduction Program

- Penalizes hospitals in the worst-performing quartile on patient safety metrics (e.g., infection rates, PSI measures)

- Hospitals in the worst-performing quartile receive a flat 1% reduction in total IPPS payments; there are no bonuses

- Blunt, threshold-based incentive focused squarely on inpatient safety and has raised concerns about measurement noise and weak differentiation among hospitals

- HAC Tracker

P4P and Pricing

How?

There are several mechanisms by which P4P programs can influence a hospital’s negotiated price with insurers: - increasing costs - differentiation (e.g., quality improvement or changes in services) - service mix - bargaining

Costs

- P4P may increase real operating costs

- care coordination

- discharge planning

- post-acute management

- If these investments raise costs across all patients, hospitals may seek higher prices from private insurers

Differentiation

- Efforts to reduce readmissions may reflect genuine quality improvements

- Hospitals may position themselves as:

- lower readmission

- better coordinated

- higher value

- Insurers and employers may be willing to pay higher prices for perceived improvements in quality

Service mix

- Hospitals may adjust:

- admissions policies

- intensity of care

- types of services emphasized

- These responses can change the average price observed even if per-service negotiations are unchanged

Bargaining

- Lowering Medicare margins may change hospitals’ incentives in negotiations:

- greater urgency to secure favorable commercial contracts

- less willingness to accept low-price agreements

- Effects depend on relative bargaining power and market structure

- This is a form of “cost-shifting” (although not a mechanical pass-through)

What is Cost-shifting?

- Some concern that when Medicare lowers payment rates, hospitals may respond with higher prices for private-insurance patients

- Is this possible?

- No: If hospitals can unilaterally set prices, they would lower prices to get the marginaly lower WTP patients (not relevant in a bargaining context)

- No: Hospitals must negotiate with insurance companies, and if they could have negotiated a higher rate, they would have done so earlier

- Yes: If profits enter into a hospital’s objective function nonlinearly, then reductions in profit could provide upward pricing pressure

- Policy-makers and hospitals say yes (but for simpler reasons)

- Economists often say no under standard bargaining models, though this depends on assumptions about objectives, constraints, and market structure

Where we’re headed

- Empirical question: do P4P programs affect hospital prices?

- Why might we have an endogeneity problem here?

- What we need to answer this question:

- Hospital prices

- Penalty status

- Some “exogenous” source of variation in penalty status…