hcris.data <- read_csv("../data/output/hcris-snippets/hcris-data.csv")

hcris.price <- hcris.data %>%

filter(year %in% c(2011, 2014)) %>%

select(provider_number, price, year) %>%

pivot_wider(names_from=year, values_from=price, names_prefix="price_")

hcris.hrrp <- hcris.data %>%

filter(year==2012) %>%

mutate(hrrp_penalty=if_else(hrrp_payment>0 & !is.na(hrrp_payment), hrrp_payment/1000, 0)) %>%

select(provider_number, hrrp_penalty) %>%

mutate(any_penalty=(hrrp_penalty>0))

hcris.mcare <- hcris.data %>%

filter(year<2012) %>%

group_by(provider_number) %>%

summarize(avg_mcare=mean(mcare_discharges, na.rm=TRUE)/100) %>%

ungroup()

hcris.final <- hcris.price %>%

left_join(hcris.hrrp, by="provider_number") %>%

left_join(hcris.mcare, by="provider_number") %>%

filter(!is.na(price_2011), !is.na(price_2014)) %>%

mutate(price_change=price_2014-price_2011)Instrumental Variables: Part II

Outline for Today

- HRRP Penalties and Pricing

- IV in Practice

Organize Data

First we need to organize the data into something we can analyze with IV in this setting

- Reduce to cross-sectional data (we’ll deal with panel data in the next module)

- Focus on price changes, not levels

- Maintain Medicare discharges as our key instrument

import pandas as pd

import numpy as np

# read

hcris_data = pd.read_csv("../data/output/hcris-snippets/hcris-data.csv")

# --- prices (wide) ---

hcris_price = (

hcris_data.loc[hcris_data["year"].isin([2011, 2014]), ["provider_number", "price", "year"]]

.pivot(index="provider_number", columns="year", values="price")

.rename(columns=lambda y: f"price_{int(y)}")

.reset_index()

)

# --- HRRP (2012) ---

hcris_hrrp = (

hcris_data.loc[hcris_data["year"].eq(2012), ["provider_number", "hrrp_payment"]]

.assign(

hrrp_penalty=lambda df: np.where(

(df["hrrp_payment"] > 0) & df["hrrp_payment"].notna(),

df["hrrp_payment"] / 1000, # $1000s

0.0

)

)

.loc[:, ["provider_number", "hrrp_penalty"]]

.assign(any_penalty=lambda df: df["hrrp_penalty"] > 0)

)

# --- Medicare discharges instrument: avg pre-2012 ---

hcris_mcare = (

hcris_data.loc[hcris_data["year"] < 2012, ["provider_number", "mcare_discharges"]]

.groupby("provider_number", as_index=False)

.agg(avg_mcare=("mcare_discharges", lambda x: np.nanmean(x) / 100))

)

# --- final merge + long difference outcome ---

hcris_final = (

hcris_price

.merge(hcris_hrrp, on="provider_number", how="left")

.merge(hcris_mcare, on="provider_number", how="left")

)

hcris_final = (

hcris_final.loc[hcris_final["price_2011"].notna() & hcris_final["price_2014"].notna()]

.assign(price_change=lambda df: df["price_2014"] - df["price_2011"])

)# A tibble: 6 × 7

provider_number price_2011 price_2014 hrrp_penalty any_penalty avg_mcare

<chr> <dbl> <dbl> <dbl> <lgl> <dbl>

1 010001 4476. 5361. 0 FALSE 79.8

2 010005 1327. 1557. 0 FALSE 22.3

3 010006 4612. 4604. 0 FALSE 51.9

4 010007 840. 423. 0 FALSE 10.8

5 010011 8310. 5159. 0 FALSE 41.8

6 010012 6774. 6414. 0 FALSE 17.4

# ℹ 1 more variable: price_change <dbl>Understanding this Dataset

- Difference prices to remove time-invariant hospital characteristics

- Can then estimate a cross-sectional IV model where cumulative HRRP penalties are instrumented using pre-period Medicare volume

- Sometimes referred to as IV with long-differenced outcomes

Why Price Differences (instead of levels)?

Assume a simple two-period model for hospital \(i\) in years \(t \in \{2011, 2014\}\): \[p_{it} = \beta\,\text{pen}_{i,t-2} + \alpha_i + u_{it},\] where \(\alpha_i\) is a time-invariant hospital fixed effect (e.g., hospital 1 is just different than hospital 2 in some time-invariant way).

Take the long difference (2014 minus 2011): \(\Delta p_i \equiv p_{i,2014}-p_{i,2011}.\)

Substitute the model into both terms and difference: \[\Delta p_i= \beta(\text{pen}_{i,2012}-\text{pen}_{i,2009}) + (\alpha_i-\alpha_i) + (u_{i,2014}-u_{i,2011}).\]

Because \(\alpha_i\) does not change over time, it cancels: \[(\alpha_i-\alpha_i)=0 \quad \Rightarrow \quad \Delta p_i = \beta\,\Delta \text{pen}_i + \Delta u_i.\]

Differencing removes any time-invariant hospital-level confounder captured by \(\alpha_i\).

Time-varying hospital shocks remain in \(\Delta u_i\).

Naive OLS Estimate

Before moving to IV, let’s look first at a simple OLS estimate, ignoring any potential endogeneity problems

Call:

lm(formula = price_change ~ hrrp_penalty, data = hcris.final)

Residuals:

Min 1Q Median 3Q Max

-884980 -1338 -142 1170 880921

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 276.798 525.707 0.527 0.599

hrrp_penalty 4.562 15.707 0.290 0.771

Residual standard error: 25450 on 2512 degrees of freedom

(5 observations deleted due to missingness)

Multiple R-squared: 3.359e-05, Adjusted R-squared: -0.0003645

F-statistic: 0.08438 on 1 and 2512 DF, p-value: 0.7715Is this causal?

Lots of reasons some hospitals might be penalized versus others. Any ideas?

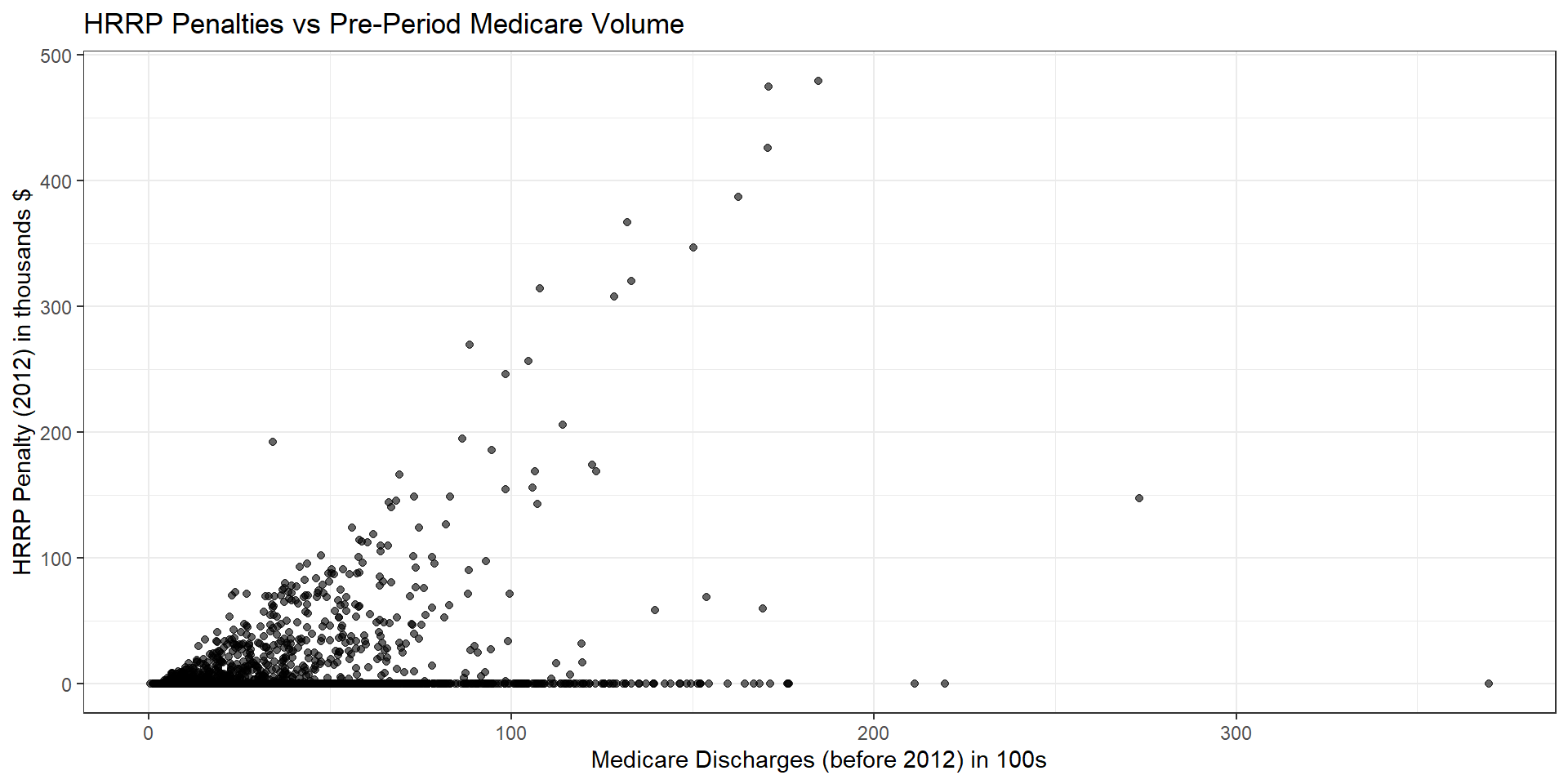

Instrumental Variables in Practice

Medicare Discharges (at baseline) as an IV

Assessment of Instrument

Before looking at IV results, Let’s examine the first-stage and the reduced form:

first.stage <- feols(hrrp_penalty ~ avg_mcare, data=hcris.final)

red.form <- feols(price_change ~ avg_mcare, data=hcris.final)

modelsummary(list("First Stage"=first.stage, "Reduced Form"=red.form),

keep=c("avg_mcare"),

coef_map=c("avg_mcare"="Pre-HRRP Medicare Discharges"),

gof_map=c("nobs", "r.squared"))import statsmodels.formula.api as smf

# first stage

first_stage = smf.ols("hrrp_penalty ~ avg_mcare", data=hcris_final).fit()

# reduced form

red_form = smf.ols("price_change ~ avg_mcare", data=hcris_final).fit()

print(first_stage.summary())

print(red_form.summary())

import pandas as pd

table = pd.DataFrame({

"First Stage": [

first_stage.params["avg_mcare"],

first_stage.bse["avg_mcare"],

first_stage.nobs,

first_stage.rsquared

],

"Reduced Form": [

red_form.params["avg_mcare"],

red_form.bse["avg_mcare"],

red_form.nobs,

red_form.rsquared

]

},

index=[

"Pre-HRRP Medicare Discharges",

"Std. Error",

"N",

"R-squared"

])

print(table)| First Stage | Reduced Form | |

|---|---|---|

| Pre-HRRP Medicare Discharges | 0.322 | 38.450 |

| (0.019) | (16.091) | |

| Num.Obs. | 2514 | 2519 |

| R2 | 0.098 | 0.002 |

- Sign of reduced form in the expected direction

- First-stage coefficient is positive, with F-stat of nearly 290

IV Results

- Now time to implement “official” IV estimator

- Note…\(R^2\) no longer relevant measure of model fit for IV as the standard variance decomposition no longer holds

- Note also…I’m not worried here about statistical inference (standard errors are likely wrong and would be larger under heteroskedasticity and smaller when considering a “richer” specification)

ols <- feols(price_change ~ hrrp_penalty, data=hcris.final)

iv <- feols(price_change ~ 1 | hrrp_penalty~avg_mcare, data=hcris.final)

modelsummary(list("OLS"=ols, "IV"=iv),

keep=c("hrrp_penalty"),

coef_map=c("hrrp_penalty"="HRRP Penalty ($1000s)", "fit_hrrp_penalty"="HRRP Penalty ($1000s)"),

gof_map=c("nobs"))import pandas as pd

import statsmodels.formula.api as smf

# --- OLS ---

ols = smf.ols("price_change ~ hrrp_penalty", data=hcris_final).fit()

# --- IV / 2SLS (linearmodels is the closest analogue to fixest IV) ---

from linearmodels.iv import IV2SLS

iv = IV2SLS.from_formula(

"price_change ~ 1 + [hrrp_penalty ~ avg_mcare]",

data=hcris_final

).fit(cov_type="robust")

print(ols.summary())

print(iv.summary)

# --- modelsummary-like table (coef, SE, N only) ---

out = pd.DataFrame(

{

"OLS": {

"HRRP Penalty ($1000s)": ols.params["hrrp_penalty"],

"Std. Error": ols.bse["hrrp_penalty"],

"N": int(ols.nobs),

},

"IV": {

"HRRP Penalty ($1000s)": iv.params["hrrp_penalty"],

"Std. Error": iv.std_errors["hrrp_penalty"],

"N": int(iv.nobs),

},

}

)

print(out)| OLS | IV | |

|---|---|---|

| HRRP Penalty ($1000s) | 4.562 | 119.026 |

| (15.707) | (50.580) | |

| Num.Obs. | 2514 | 2514 |

Some other IV issues

- IV estimators are biased. Performance in finite samples is questionable.

- IV estimators provide an estimate of a Local Average Treatment Effect (LATE), which is only the same as the ATT under strong conditions or assumptions.

- What about lots of instruments? The finite sample problem is more important and we may try other things (JIVE).

The National Bureau of Economic Researh (NBER) has a great resource here for understanding instruments in practice.

Quick IV Review

- When do we consider IV as a potential identification strategy?

- What are the main IV assumptions (and what do they mean)?

- How do we test those assumptions?