Health Insurance: A New Language

Ian McCarthy | Emory University

Table of contents

- Motivation

- How insurers shape coverage

- How patients pay for coverage

- Real-life example

Motivation

What is health insurance?

Why do people buy health insurance? What are they insuring?

What is health insurance?

Health insurance can still improve health by:

- improving affordability of care (by paying for some part of care when needed)

- facilitating availability of care (providers receive lower payments for “cash” patients)

Made more important due to extremely high healthcare prices

How does health insurance work?

- Enrollees pay the insurer

- Fixed amount per month (premium)

- Some amount for care provided (cost-sharing)

- Fixed amount per month (premium)

- Insurer pays provider

- Negotiated prices

- Pays share of bill depending on cost-sharing terms

- Negotiated prices

How does health insurance work?

- Modern health insurance is very complicated!

- Need to work through some basic terminology before we go much further

How insurers shape coverage

Managed care

- Health insurance product that encompasses some attempt to manage utilization of care

- Insurers “manage” care through the use of networks of providers

Insurance networks

Set of providers with whom the insurer has agreed to terms of payment

- PPOs: tiered network structure → patients pay less at higher-tier providers

- HMOs: discrete structure → some providers in-network, others entirely out-of-network

Benefit design

Insurers also decide:

- What services are covered

- hospital visits, prescription drugs, mental health services, etc.

- hospital visits, prescription drugs, mental health services, etc.

- What patients pay

- premium, deductible, co-payment, co-insurance

This “benefit design” sets the rules for patient payments.

How patients pay for coverage

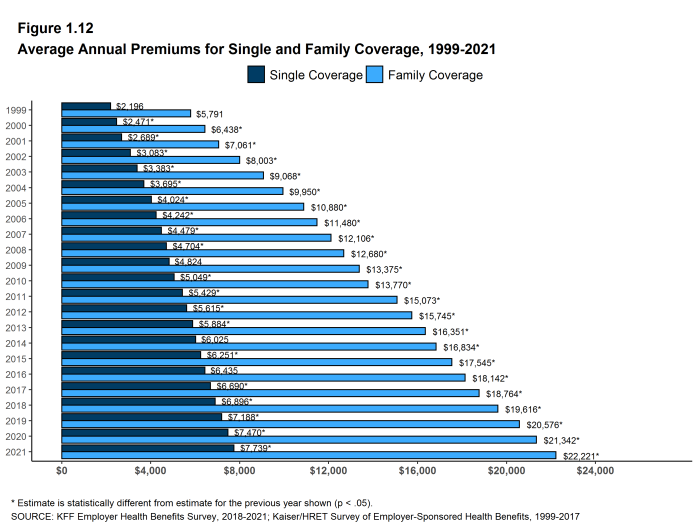

Premiums

Fixed monthly amount paid for coverage, regardless of whether care is used

Cost-sharing

Patient payments when care is used

- Deductible

- Co-insurance

- Co-payment

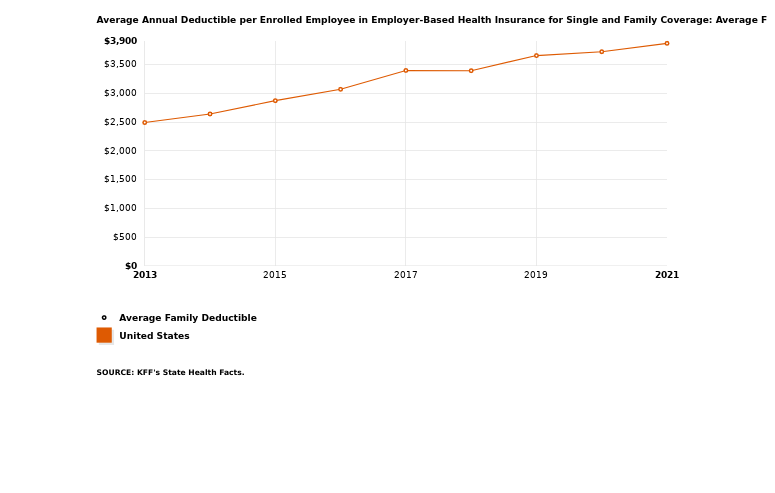

Deductible

The amount the patient must pay out-of-pocket before insurance pays anything

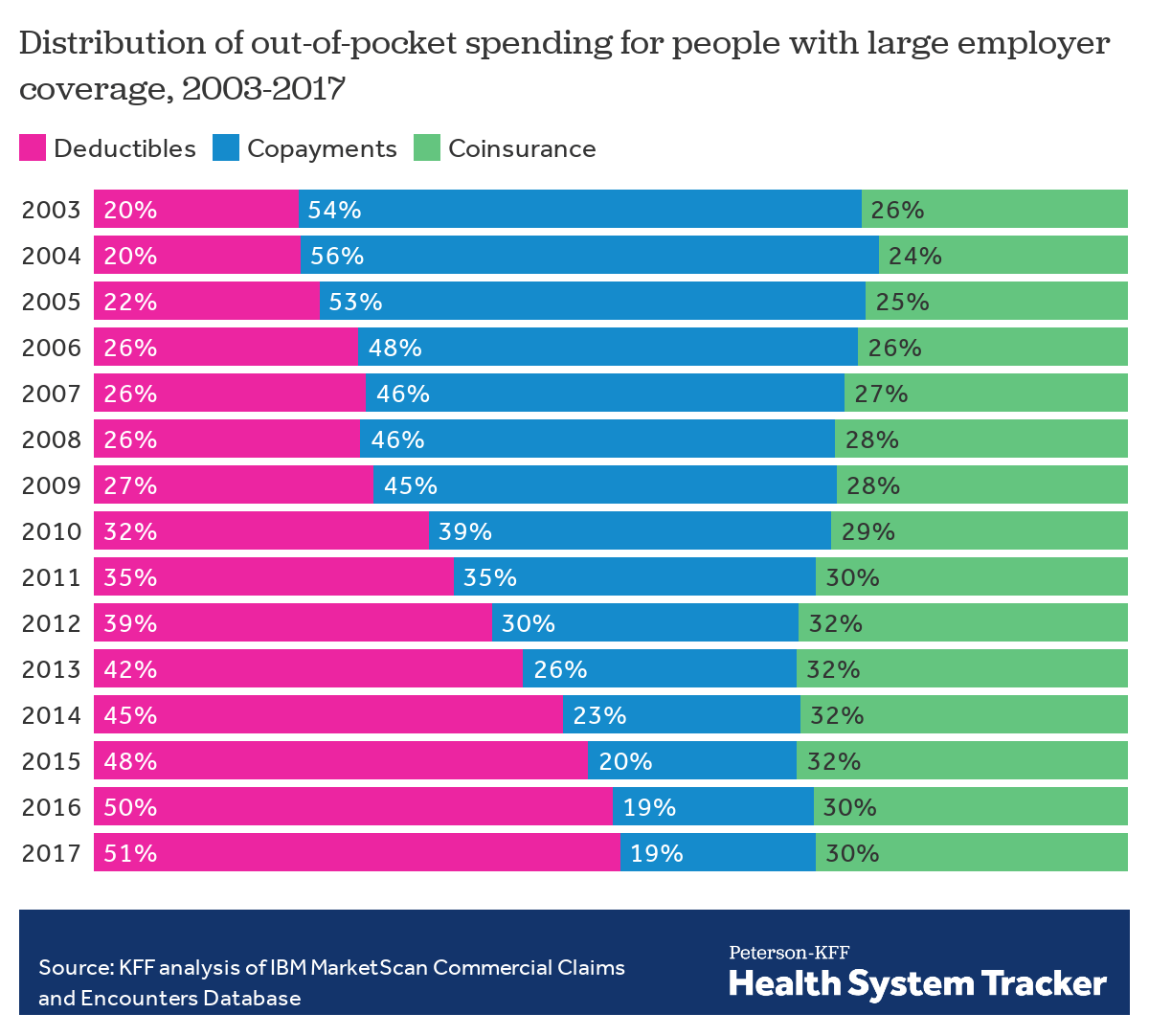

Copayment

A fixed dollar amount for a service (after deductible is met)

- Common for low-cost, predictable care (e.g., office visits, prescriptions)

- Example: $20 co-pay for an office visit

Coinsurance

A percentage of costs (after deductible is met)

- Example: 20% coinsurance rate on a $5,000 hospital bill

- Patient pays $1,000

- Insurer pays $4,000

- Patient pays $1,000

- Common for larger, less predictable services (hospital stays, ER visits)

Cost-sharing over time

Summary

How insurers shape coverage

- Managed care (steerage via networks)

- PPO: tiered coverage; out-of-network covered but less generous

- HMO: coverage limited to in-network providers

- Benefit design

- Covered services (e.g., hospital, prescriptions, mental health)

- Premiums and cost-sharing rules (deductible, co-payment, co-insurance)

How patients pay for coverage

- Premiums: fixed monthly payment for coverage

- When care is used

- Deductible: amount paid before insurer pays anything

- Co-payment: fixed $ per service

- Co-insurance: % of allowed amount

- Network choice matters

- In-network: negotiated allowed amounts

- Out-of-network: provider charges (often much higher)

Real-life example

- Let’s look at some real-life health insurance options and descriptions

- Emory’s health insurance plans for its employees