Public Health Insurance

Ian McCarthy | Emory University

Table of contents

- Medicare

- Medicaid

- Veterans Health Administration and TRICARE

Framing

- Public programs insure tens of millions of people in the United States

- Programs differ in who they cover, how they are financed, and how they pay providers

- We focus on Medicare, Medicaid, and the Veterans Health Administration, with a note on TRICARE

Medicare

Basics of Medicare

- Created by the Social Security Amendments of 1965

- Covers people age 65 and older and certain younger adults with disabilities

- A meaningful share of beneficiaries are under 65 due to disability eligibility

The four parts of Medicare

- Part A: Hospital insurance

- Part B: Medical insurance for physician and outpatient care

- Part C: Medicare Advantage, private plans that deliver Parts A and B benefits

- Part D: Prescription drug coverage, offered by private plans

Medicare Part A

- Automatic for most people at 65 with sufficient work history

- Financed by payroll taxes and beneficiary cost sharing

- Funds flow through the Hospital Insurance Trust Fund, which cannot borrow

- Benefit design:

- Strong coverage for short inpatient stays

- Much weaker protection for very long stays

- Limited skilled nursing facility coverage and no long term custodial care

- Strong coverage for short inpatient stays

Medicare Part B

- Voluntary but most beneficiaries enroll

- Monthly premium is required

- Small annual deductible and coinsurance that is typically 20 percent for many services

Medicare Part C: Medicare Advantage

- Private insurers provide Medicare benefits under contract with the federal government

- Plans receive risk adjusted payments per enrollee

- Often include extra benefits and integrated Part D coverage

- Networks and utilization management are common, which can lower premiums but limit provider choice

Quick poll

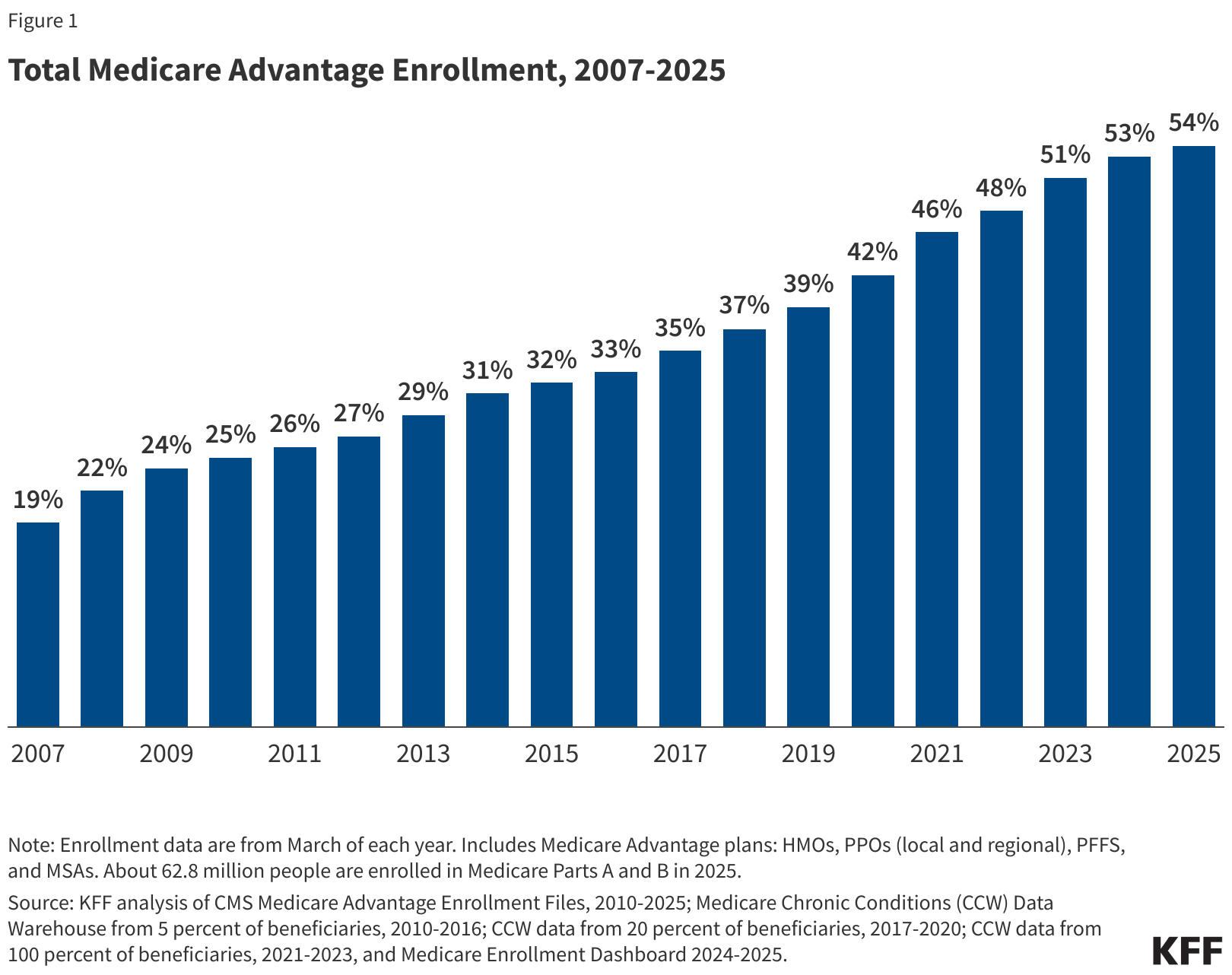

🤔 What share of Medicare beneficiaries do you think are enrolled in Medicare Advantage today?

- About one quarter

- About one third

- About one half

- More than two thirds

(We’ll check the answer against the KFF data on the next slide.)

Medicare Part C: Medicare Advantage

Medicare Part D

- Prescription drug coverage offered by private plans

- Plans receive payments to enroll beneficiaries, with additional low income subsidies

- Many plans are offered as combined Medicare Advantage plus Part D options

Case study

Mary is 67 and newly eligible for Medicare. She has diabetes and uses several prescription drugs.

- Option 1: Traditional Medicare + Part D + Medigap

- Option 2: Medicare Advantage plan with prescription coverage

👉 Which do you think might cost less out of pocket for Mary?

👉 Which option might limit her choice of providers more?

Privatization and enrollment trends

- Medicare Advantage enrollment has grown and now accounts for a large share of beneficiaries

- Risk adjustment reduced but did not fully remove selection concerns

- Traditional Medicare remains important for beneficiaries who prefer broad provider choice

Medicare payments for inpatient services

Prospective payment under Diagnosis Related Groups (DRGs)

Payment begins with standardized base rates for operating and capital costs

- Operating base rate (FY 2025): $6,624

- Capital base rate (FY 2025): $512

- Operating base rate (FY 2025): $6,624

Adjusted by:

- DRG weight (severity/case mix)

- Hospital characteristics (teaching status, disproportionate share, rural location, wage index, etc.)

- DRG weight (severity/case mix)

See CMS DRG definitions and weights:

Recent payment directions

- Quality incentives for hospitals

- Value Based Purchasing

- Hospital Readmission Reduction Program

- Value Based Purchasing

- Physician payment reform

- Quality Payment Program with a choice between a merit based pathway and advanced alternative payment models

- Quality Payment Program with a choice between a merit based pathway and advanced alternative payment models

- Experiments with population or episode based payments

- Bundled payments

- Accountable Care Organizations

- Bundled payments

Medicaid

Background

- Created in 1965 as a joint federal and state program

- Covers low income adults and children, pregnant people, people with disabilities, and many older adults needing long term services and supports

- Program rules vary by state within federal guidelines

- A large share of births are covered by Medicaid or CHIP

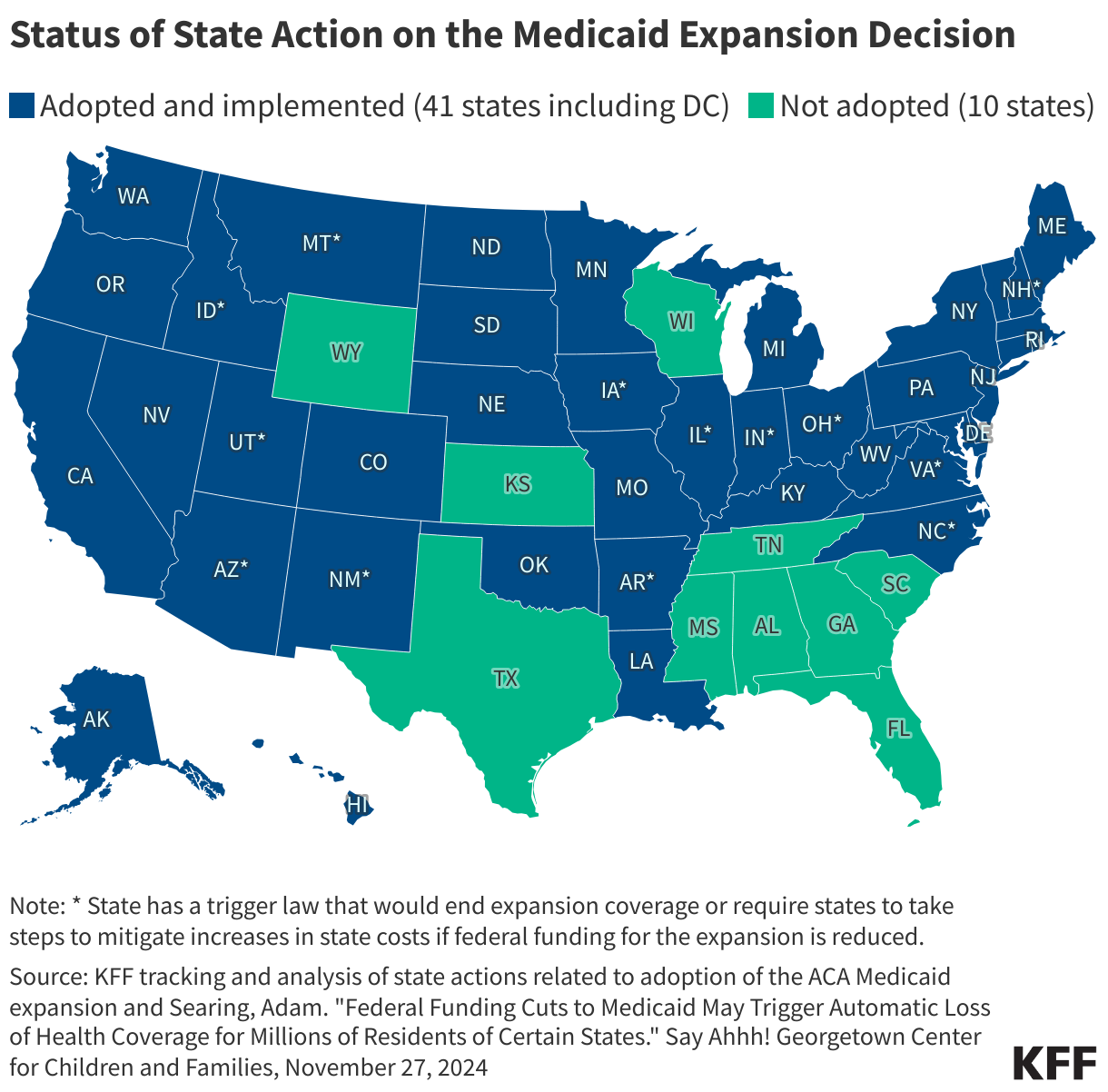

Medicaid expansion under the ACA

- The ACA offered states the option to expand coverage to adults under 65 with incomes up to 138 percent of the federal poverty level

- The Supreme Court made expansion optional for states

- Expansion increased coverage for adults without dependent children in many states

Predict the map

How many states do you think have adopted the ACA Medicaid expansion?

- Less than half?

- About two thirds?

- Nearly all?

(Let’s see the actual map next.)

Medicaid Expansion

Medicaid financing

- States and the federal government share costs

- The federal match rate depends on state per capita income

- The match structure creates strong budget incentives for states

Medicaid benefits

- Broad coverage of hospital, physician, and prescription services

- Low to no cost sharing for many enrollees

- Coverage of long term services and supports is a key feature that distinguishes Medicaid from Medicare

Medicaid payments

- Traditional fee schedules set by states pay providers directly

- States also use supplemental payments such as disproportionate share adjustments

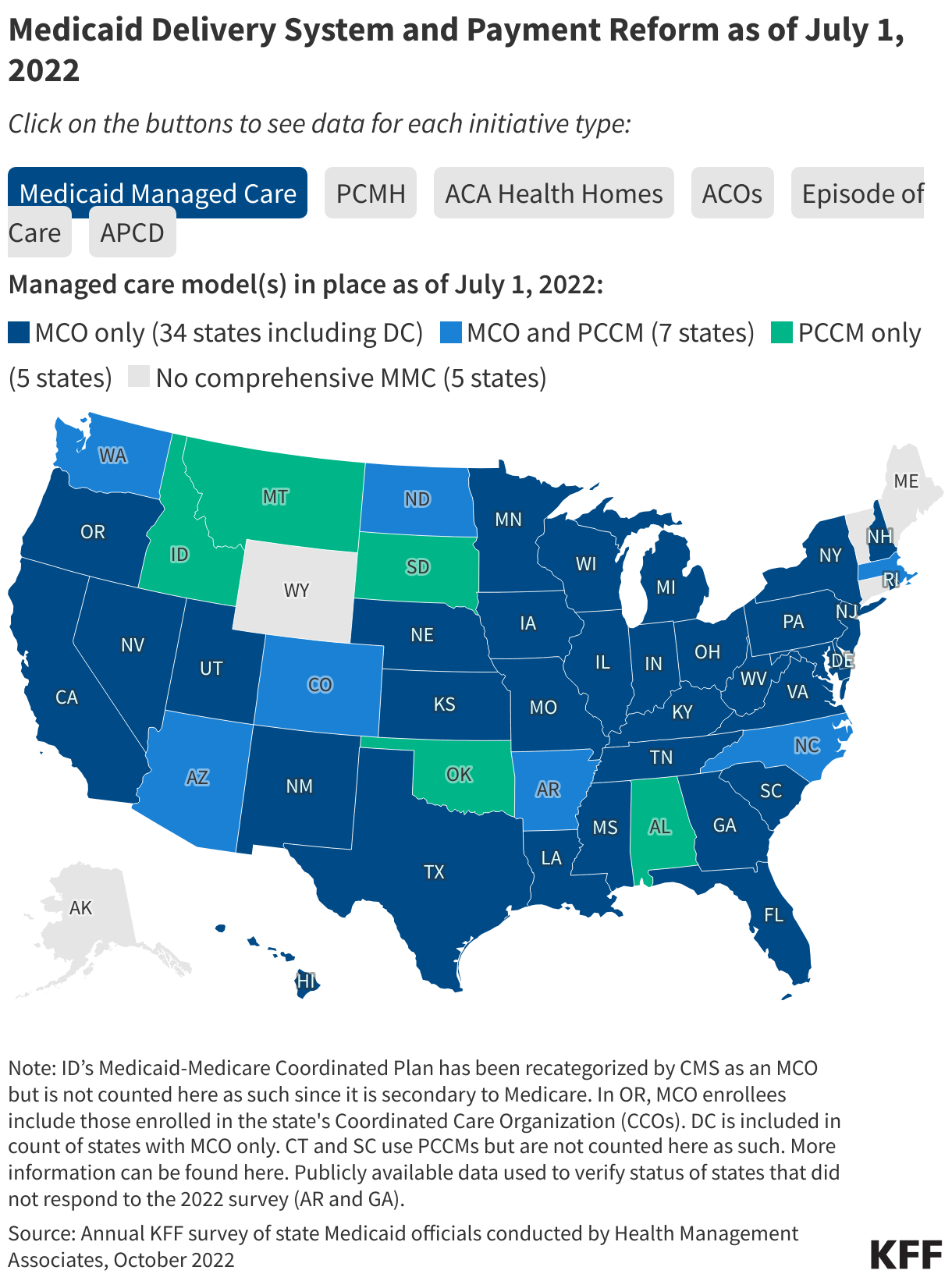

- Today: ~80% of enrollees are in Medicaid Managed Care Organizations (MCOs)

Medicaid managed care

Medicaid managed care

- States pay private insurers a capitated amount per enrollee

- Insurers then build networks, negotiate rates, and manage utilization

- Reasons for shift:

- Cost control

- Better coordination of care

- Access to broader provider networks

- Cost control

👉 Raises questions: does privatization improve outcomes, or just shift who manages the dollars?

Veterans Health Administration and TRICARE

Veterans Health Administration

- Integrated insurer and provider that operates its own hospitals and clinics

- Clinicians are employed by the VA and care is funded through congressional appropriations

- Focus on services that address the needs of veterans, including mental health and rehabilitation

- Eligible veterans face modest or no cost sharing for many services

TRICARE

- Department of Defense program for active duty service members, retirees, and their families

- Functions more like traditional insurance with private provider networks

- Exists alongside the VA, which operates its own delivery system focused on veterans

- Key distinction: TRICARE primarily covers active duty personnel and dependents, while the VA primarily serves veterans after discharge, though some individuals may have access to both

Putting it together

Compare payment approaches

- Medicare: administratively set prices, prospective payment for hospitals, fee schedules for clinicians

- Medicaid: state fee schedules or capitated managed care payments, with generally lower rates than Medicare or commercial insurance

- VA: budget funded and vertically integrated delivery system, with limited use of outside networks for certain services