Introduction to Prescription Drugs

Ian McCarthy | Emory University

Pharmaceutical Spending

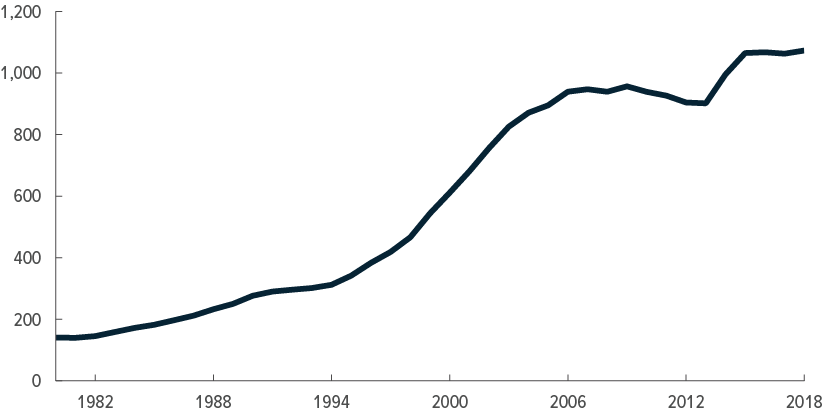

High spending per person

Relatively small share of health care

Prescription Drug Life Cycle

Three Broad Stages

- Research and Development

- Marketing

- Sales

Research and Development

R&D Timeline

- 10-15 years from discovery to manufacturing

- Discovery: screening, target identification, pre-clinical testing

- < 5% of candidate compounds make it to pre-clinical testing

- Clinical Trials: official testing for FDA approval (up to 10 years total)

Clinical Trials

- 20% of drugs in pre-clinical discovery make it to clinical trials

- Pre-clinical: submission of investigational new drug application (IND)

- Phase I: testing on healthy, human volunteers, focus on side effects

- Phase II: testing on relevant patient population, focus on efficacy

- Phase III: testing on large patient population, focus on safety and efficacy

- FDA review and approval, submission of new drug application (NDA)

FDA Approval

- Physicians can prescribe drugs for off-label uses, without FDA approval

- FDA approval is required for marketing and insurance coverage

- FDA approval can be narrow, and generally does not cover all uses

- Companies often continue clinical trials after approval to expand uses

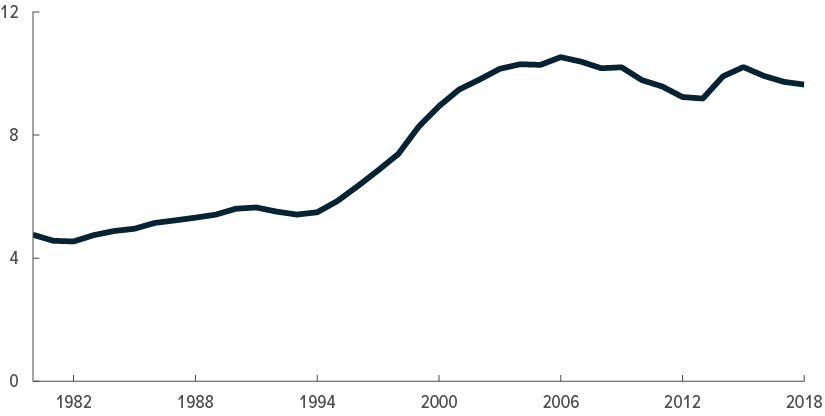

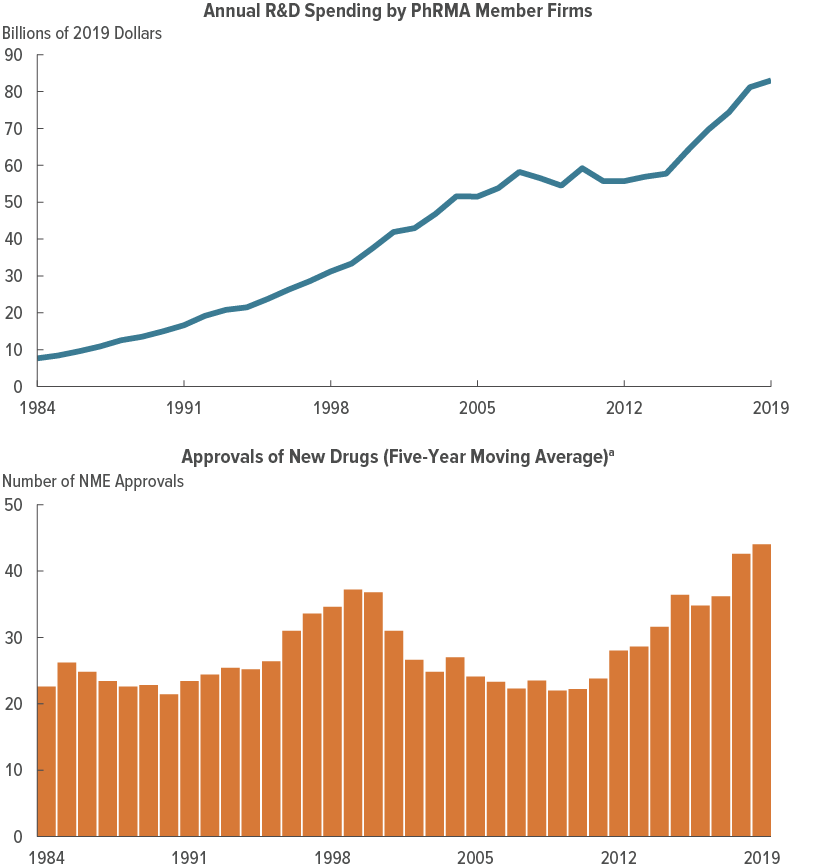

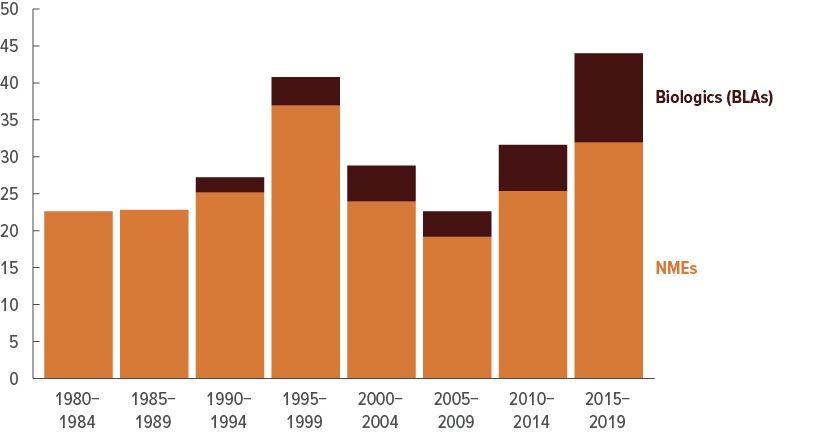

R&D Spending

New Drug Approvals

Marketing

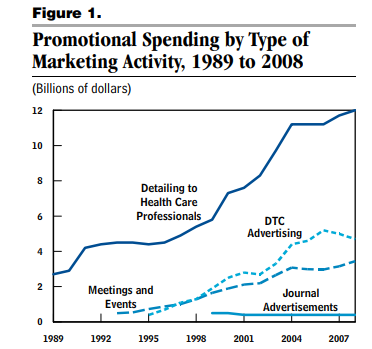

Marketing Expenditures

Marketing Expenditures

- About $6 billion per year on direct-to-consumer advertising (primarily TV and magazine), based on 2018 data

- Nearly 3x that on detailing (sales reps visiting physicians), based on 2008 data

- Over $20 billion per year on free samples, based on 2005 data

Sales

Supply chain (relatively standard)

- Manufacturers (that’s easy)

- Sell to wholesalers (e.g., McKesson, Cardinal Health, AmerisourceBergen) in most cases (60-70%) or directly to pharmacies (mainly large chains)

- Sell to retail and non-retail (e.g, hospitals, nursing homes, home health care) pharmacies

- Sell to patients

Flow of money (non-standard)

- Manufacturers set list prices

- Wholesalers negotiate discounts and rebates, sell to pharmacies at a markup

- Pharmacy benefit managers (PBMs) administer formularies and negotiate discounts and rebates with manufacturers and insurers

- Pharmacies sell to patients at a markup

What is the price?

- Insurers pay PBMs to manage drug benefits

- Manufacturers pay rebates to insurers and pharmacy benefit managers (PBMs)

- Medicaid has mandatory rebates (over 20% of wholesale price)

- For brand name drugs, rebates are sizeable and opaque. Hard to know what the price is.

Factors affecting price

- Manufacturer market power

- Patent protection provides monopoly power for 20 years, applied for during discovery period

- 10 years of effective monopoly power given R&D and approval time

- Product differentiation

- Regulation and price controls

- Physician agency (already covered)