Brand Name Drugs

Pricing for Brand Name Drugs

Price?

- Recall, “price” is confusing in pharma

- Price to wholesaler, to pharmacy, to insurer, to patient

- Significant (and opaque) rebates throughout the supply chain

From Manufacturer’s Perspective

Economics of pricing for brand name drugs:

- Unique, patent-protected drug with no close substitutes (Monopoly)

- Many products with patent protection and imperfect substitutes (Bertrand differentiated products)

Monopoly Pricing

Some examples

- Lipitor (lifetime revenue of over $130 billion)

- Humira (lifetime revenue of over $100 billion)

- Advair (lifetime revenue of over $90 billion)

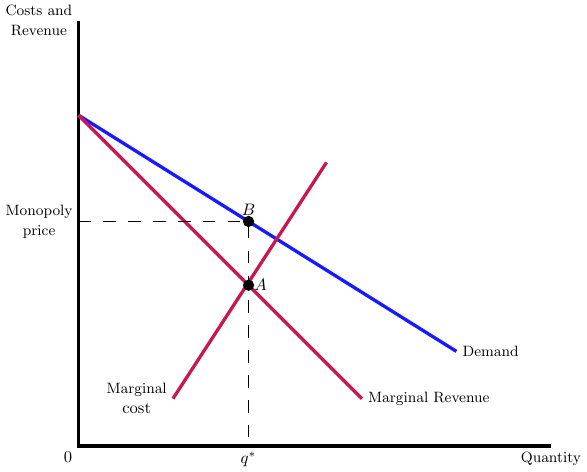

Monopoly pricing without insurance

- Inverse demand, \(p=a-b*q\)

- Costs, \(FC + c*q\)

- Profits, \(\pi = (a-c)q - bq^2 - FC\)

Profit maximizing choice of \(p, q\):

- \(q^* = \frac{a-c}{2b}\)

- \(p^* = \frac{a+c}{2}\)

Depiction of monopoly pricing

Monopoly pricing with insurance

- If insurers set co-insurance rates and copays based on a fixed price, then it wouldn’t matter much

- But…the supply price will vary depending on the form of cost sharing

- Need to consider pricing under coinsurance versus copayments separately

Monopoly pricing with coinsurance

- Denote coinsurance by \(\alpha\), with \(\alpha \in (0,1)\)

- For price \(p\), patient pays \(\alpha \times p\) and insurer pays \((1-\alpha) \times p\)

- Willingness to pay is unchanged, so new inverse demand curve is \(p = \frac{1}{\alpha}*(a - b*q)\)

- Acts as a rotation of demand, with new slope \(\frac{1}{\alpha} \times b\) (steeper demand curve, less elastic)

Monopoly pricing with coinsurance

New profit maximizing choice of \(p, q\):

- \(q^{*} = \frac{a-\alpha c}{2b}\)

- \(p^{*} = \frac{1}{2} (\frac{a}{\alpha}+c)\)

Comparison of monopoly pricing

- Monopoly price is higher with coinsurance than without

- To see this, let’s take the ratio of prices with and without coinsurance:

\[\frac{p^{*}_{c}}{p^{*}_{nc}} = \frac{\frac{1}{2} (\frac{a}{\alpha}+c)}{\frac{a+c}{2}} = \frac{1}{\alpha}\]

Monopoly pricing with copayments

- Recall copayment is a fixed amount paid by the patient

- With demand price fixed and independent of supply price, seller can set any price to insurer

- Coinsurance penalizes high prices by working down demand curve, but copayments do not

- Coinsurance shifts burden of price increases directly onto patients and confers downward price pressure relative to case of copayments

Real world example

- Speciality drugs more likely to be unique, with few close substitutes

- Theoretical prediction: coinsurance should be more common with specialty drugs versus more common drugs

- Empirical evidence: coinsurance rates increasing for specialty drugs over time, 25% in 2006 to 33% in 2009

Bertrand Differentiated Products

Setup

- Many partial (but imperfect) substitute products with market power

- Akin to brand name drug (i.e., with patent protection) with some substitutes

- Simplify to 2 drugs from two companies:

- Denote demand for drug 1 by \(q_{1}(p_{1},p_{2})\)

- Denote demand for drug 2 by \(q_{2}(p_{1},p_{2})\)

- \(\frac{d q_{i}}{d p_{j}} > 0\), so that products are substitutes

- \(\frac{d q_{i}}{d p_{i}} < 0\), as usual (downward sloping demand)

Specific Bertrand Setup

- Players: Firm 1 and Firm 2

- Actions: Each firm chooses a price \(p_{i}\) for its product.

- Demand: The demand for firm \(i\)’s product: \[q_{i} = a - bp_{i} + cp_{j}\]

- Profits: Each firm’s profit: \[\pi_{i} = (p_{i} - mc_{i})q_{i}\]

Key Points:

- \(a\) is the maximum quantity when the price is zero

- \(b\) represents how quantity demanded changes with the product’s price

- \(c\) captures the effect of the rival firm’s price on demand

Best Response Functions

Firm 1: \[p_{1}^*(p_{2}) = \frac{a + cp_{2} + mc_{1}}{2b + 1}\] Firm 2: \[p_{2}^*(p_{1}) = \frac{a + cp_{1} + mc_{2}}{2b + 1}\]

Key Points:

- Each firm’s price is a function of the other firm’s price

- Best response functions represent the optimal price choice in response to the rival’s price

Nash Equilibrium

Equating the two best response functions to solve for equilibrium prices:

\[\begin{align*} p_{1}^* &= \frac{a(2b+1) + c(a + mc_{2}) + mc_{1}(2b+1)}{2b+1 - c^2} \\ p_{2}^* &= \frac{a(2b+1) + c(a + mc_{1}) + mc_{2}(2b+1)}{2b+1 - c^2} \end{align*}\]

Key Points:

- Nash equilibrium prices are where neither firm has an incentive to change its price unilaterally

- Both firms maximize their profit given the other firm’s price

Comparison to Monopoly Pricing

Monopoly Price (previously derived): \[p_{m} = \frac{a + mc_{m}}{2b}\]

Comparison:

- Classical Monopoly vs. Competition: Monopolists set higher prices than competitive firms

- Differentiation: In Bertrand, differentiation can lead to prices closer to monopoly levels, depending on the substitution effect (parameter \(c\))

- Cost Structures: Bertrand prices depend on both firms’ costs; monopoly price only depends on its own cost

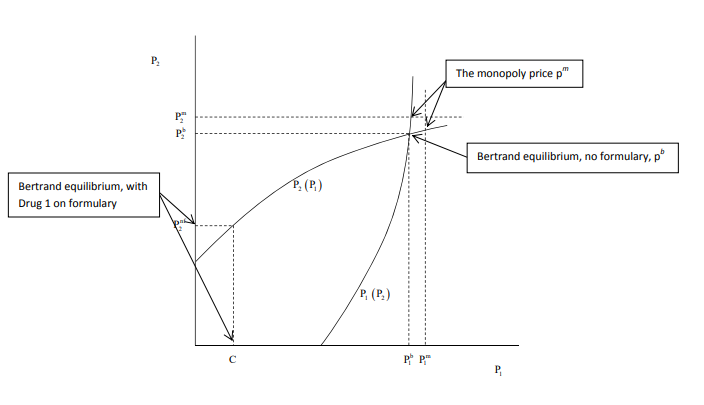

Bertrand Pricing with Insurance

- Stage 1: Insurer chooses one drug with copayment \(c\) to be on formulary. Other drug will not be covered at all

- Stage 2: Bertrand pricing with “bids” to insurer

- Stage 3: Insurer selects drug to be on formulary

Solution Idea

- Imagine firm 1 set price to original bertrand price, \(p_{1}^{b}\)

- Firm 2 can then set price to \(p_{2}^{b}=p_{1}^{b}-\epsilon\) and get most or all of the market

- So, \(p_{1}^{b}, p_{2}^{b}\) is not an equilibrium

- Firms lower price until extra sales on formularly are less than profit of drug off formulary

- Final prediction: Insurers used tiered formularies and copayments for differentiated (but substitutable) on-patent drugs

Summary from joint hearings in FTC and DOJ

Unique drugs with patent protection:

Under these circumstances, there is little opportunity for a purchaser to stimulate competition among manufacturers. Manufacturers are roughly free to set launch prices, they rarely discount those prices, and purchasers and price takers.

Differentiated drugs with imperfect substitutes:

This stage represents the lion’s share of the market at any given time…Depending on how similar the drugs are…organized purchasers have the ability to either switch patients in a medially appropriate way…or at least start new patients on a preferred drug…This is the area where formularies can be applied for the greatest effect on overall costs.